Advancing Communities Together Deposit Program

Socially responsible deposits that make a difference.

The Advancing Communities Together, or ACT, Deposit Program aims to bolster funding for community lending by making it easier for a participating bank that is a community development financial institution (CDFI) or minority depository institution (MDI) - "mission-focused banks" - to acquire funding from socially motivated depositors. This special program within IntraFi's ICS® service was developed as a partnership between the Community Development Bankers Association (CDBA), Intrafi, and National Bankers Association (NBA). Read our press release here.

What are mission-focused banks?

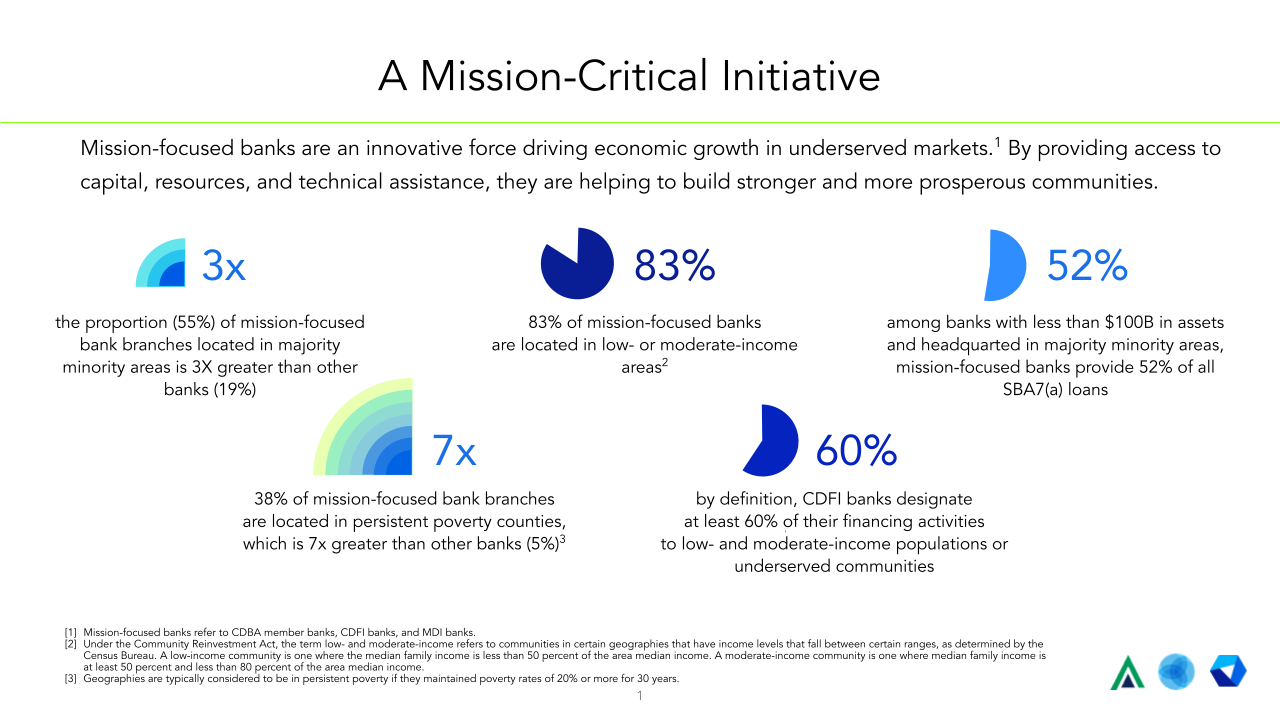

Mission-focused banks are an innovative force driving economic growth in underserved markets. By providing access to capital, resources, and technical assistance, they are helping to build stronger and more prosperous communities.

CDFI Bank: Community Development Banks are certified Community Development Financial Institutions (CDFIs). This certification, administered by the U.S. Treasury Department’s CDFI Fund, indicates the bank has devoted at least 60% of its total lending, services, and other activities to benefit low income communities.

Community Development Banks are FDIC-insured banks or thrifts that have a primary mission of promoting community development. These institutions are different from traditional banks and thrifts. They target low and moderate income markets, working in urban and rural communities that lack access to credit and are not adequately served by the traditional banking industry.

MDI Bank: An MDI (Minority Depository Institution) Bank may be a federal insured depository institution for which (1) 51 percent or more of the voting stock is owned by minority (Black, Hispanic, Asian, Pacific Islander, Native American, and female) individuals; or (2) a majority of the board of directors is minority and the community that the institution serves is predominantly minority. Ownership must be by U.S. citizens or permanent legal U.S. residents to be counted in determining minority ownership.

Visit IntraFi's ACT Deposit Program Page >>

Mission-Focused Banks: Join the ACT Deposit Program Network

The ACT Deposit Program is designed to encourage socially motivated depositors to provide new deposit funding to CDFI banks and MDI banks, thereby helping their local communities by increasing loan opportunities and banking access. It also gives CDFI banks and MDI banks an enhanced opportunity to build new banking relationships with these depositors that can extend beyond program participation. Learn more about this opportunity to acquire funding from socially responsible depositors whose investing goals align with your bank's mission.

Join the Act Program Network>>

Impact-Motivated Depositors: Place Deposits with a Mission-Focused Bank

Your organization can access multi-million-dollar FDIC insurance at IntraFi network banks and benefit many socially motivated program banks while working directly with just one. Learn more about how your deposits can impact communities in need while supporting your socially responsible investing goals.

Learn More About Placing Deposits >>